The topic of almost every platform discussion is fear about the upcoming recession. We officially hit a bear market, defined as a 20% decline in the S&P 500, on June 13th. While some people are panic selling, some of us are going to continue to build our portfolio and come out stronger than ever. How do we, not only avoid losing money but make money during a bear market?

Tips to Thrive in a Bear Market:

- Don’t follow the crowd. Resist the urge to run as the market adjusts! Investing should be a minimum of 5-10 year game. If, like most people, we give in to our fear and pull out of the market at a lower sale price then we will not only lose out in the short term but risk having to re-enter the market at a higher price during recovery.

- Automate your investments. Dollar-cost averaging or buying on a regular basis, regardless of the market, is the best way to not only reduce the stress of trying to time investments but also average out your buying price to match the overall market, over the long term.

- Let go of the fear and look at history. This is what the market does. It goes up and down. We know that everything cycles and that this is a normal and predictable part of our economy. Our brains have a negativity bias. It’s how we have survived for eons. Our ancestors were the best at looking for and focusing on what could harm them or we wouldn’t be here. Knowing this and knowing we no longer need this is the first step in changing our old thought habits. A bear market is no reason to panic and in fact is a great opportunity to increase your profit if you are mentally and physically prepared.

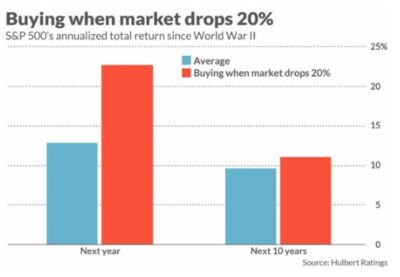

- Buy while the prices are low! Mark Hulbert of MarketWatch produced the chart below showing that since WW2, buying in a bear market has averaged a return of 22.7% within one year, or more than double the market average. So why do the majority of people sell? See #3! It takes courage to buy when our instincts tell us to run and hide. See his article by clicking the chart below.

- What to buy? Real estate of course! Real estate is one of the few asset classes that continue to produce profits during a bear market. Whether buying or renting, people still need homes, and businesses still need spaces to operate. There have been 20 bear markets in the US since 1952. Only 2 of these downturns affected the real estate market! As we have gone over many times in our past newsletters, the one that took place beginning in 2007 was based on shady lending practices that have since been mitigated. The second only saw a decline of 0.4%. In the remaining 18 bear markets, real estate values increased! I also personally diversify by investing in companies that I, not only research but use and believe in their products. While I obviously cannot guarantee results, I love this topic so please call me to discuss! Here’s what’s up in our local market…

We had a small increase in inventory in both condos and houses this week but as you can see price reductions are starting to increase as the market is settling down. Hopefully we will get an increase in inventory as a more balanced market is more conducive for people looking to relocate. A balanced market is the time to not only sell at a profit but also to be able to buy at a more reasonable price.

We had 1 new condo and 2 new homes come onto the market this week. We currently have 32 active condos ranging from $399,000 to $5,425,000; the median condo price is $808,500. We currently have 47 active homes on the East Shore ranging from $1,098,000 to $64,500,000 with the median price of $3,150,000. Here’s a year to date local update:

Local East Shore Lake Tahoe, Nevada Stats – All Year to Date

- Total Sales YTD: Condos: 54 | Homes: 43

- The Median Sales Price: Condos: $702,500 | Homes: $1,750,000

- Number of Sales Over $1 Million: Condos: 12 = 22% | Homes: 39 = 89%

- The Highest Priced Sale: Condos: $5,665,500 (Tahoe Beach Club) | Homes: $32,000,000

- Median Price Per Square Foot: Condos: $594.74 | Homes: $628.13

- Median Days on the Market: Condos: 74 | Homes: 80

- Price Reductions this Week: Condos: 5 | Homes: 6

Your Realtor should not only be someone you trust in knowing the real estate market but also in wealth building, preservation and management. At the Zager Group, we don’t take this responsibility lightly. We are committed to continuously learning and sharing about making the wisest choices for our future and the future of our friends and clients. We pride ourselves in being experts in this field. If someone you care about needs guidance or recommendations, please share our contact information as we are honored to be able to help! If you would like to receive our in-depth market update or would like an evaluation of your property’s value we would love to hear from you! We’ve put together some information below that we think you’ll find useful. If you have anything you want to share with our community please let us know so that it can be included in future newsletters.

Thank you!

Craig Zager & The Zager Group