Riding the wave…just like with the stock market, if you are poised and ready for the inevitable ebb and flow of the real estate market, you can not only survive but set yourself up for a better financial future.

We made it through Q3 and are headed for the grand finale of 2022! Below is a quick summary of the year so far. We will be sending out our in depth quarterly market analysis shortly so make sure we have your physical mailing address if you want to be included.

This year inflation reached a forty year high. As a general rule, when inflation is low, mortgage rates tend to be lower. When inflation is high, rates tend to be higher. Although higher mortgage rates have helped to slow the craziness of the real estate market frenzy, inflation is not bad news for the housing market. For example from 1975 – 1984 interest rates went from 9% to 13%, national housing prices went from $37,000 to $81,600 because the inflation rates were at all time highs. In general, inflation actually increases the value of real estate. As the cost of materials and labor increase, the cost of building increases, and therefore the value of your home increases. For example, if the cost of building 5 years ago doubled, the value of a home built 5 years ago may also double. Inflation has been one of the reasons that house prices have continued to gradually increase despite higher mortgage rates and a slight increase in housing supply.

So what’s next? Nationally, housing market activity tends to decrease by about 15% in the fourth quarter, a period that is usually the slowest of the year. However, locally we typically see an increase in activity in the fall before slowing down for the holidays.

Most economists expect home prices to continue to increase in 2023, despite mortgage rates and fear of recession because of the ongoing inventory issue. There simply aren’t nearly enough homes for every buyer who wants one.

Trying to time the market or predict what will happen in the future is a waste of time and money. Buy based on your budget and future goals. If you are in a good financial position, you may want to commit to purchase while there is a bit of a reprieve. You can always refinance your mortgage down the road when rates are lower.

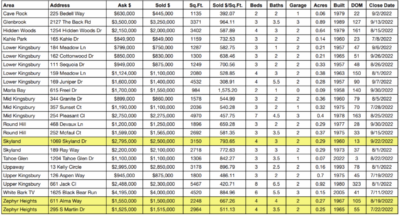

Q3 Sales

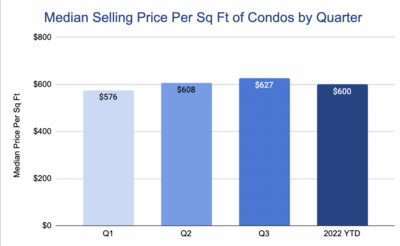

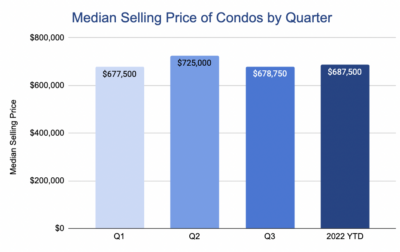

CONDOS

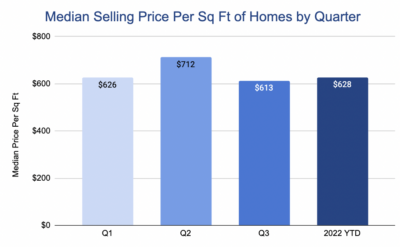

SINGLE FAMILY

OUR MARKET THIS WEEK

We had 2 new condos and 2 new homes come onto the market this week. We currently have 30 active condos ranging from $420,000 to $2,995,000; the median condo price is $821,500. We currently have 43 active homes on the East Shore ranging from $1,075,000 to $64,500,000 with the median price of $3,250,000.

Here’s a year-to-date local update:

Local East Shore Lake Tahoe, Nevada Stats – All Year-to-Date

Total Sales YTD:

Condos: 73 (↓14% YOY) | Homes: 72 (↓45% YOY)

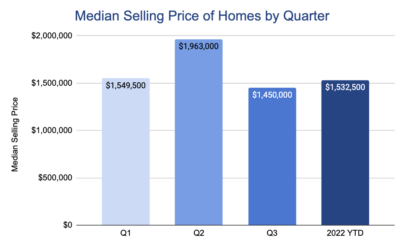

The Median Sales Price:

Condos: $680,000 (↓1% YOY) | Homes: $1,532,500 (↑3% YOY)

Number of Sales Over $1 Million:

Condos: 16 = 22% (↑8% YOY) | Homes: 59 = 82% (↑5% YOY)

Highest Priced Sale:

Condos: $5,665,500 (↓5% YOY) | Homes: $32,000,000 (↑52% YOY)

Median Price Per Square Foot:

Condos: $603.69 (↑13% YOY) | Homes: $630.56 (↑4% YOY)

Median Days on the Market:

Condos: 73 (↑38% YOY) | Homes: 75 (↑9% YOY)

List to Sell Price:

Condos: 97% (↓8% YOY) | Homes: 96% (↓3% YOY)

Price Reductions this Week:

Condos: 2 | Homes: 1

If someone you care about needs guidance or recommendations, please share our contact information as we are honored to be able to help! If you would like to receive our in-depth market update or would like an evaluation of your property’s value we would love to hear from you! We’ve put together some information below that we think you’ll find useful. If you have anything you want to share with our community please let us know so that it can be included in future newsletters.