The State of Real Estate

Now that mortgage rates have fallen more than 1% since the recent highs, economists are optimistic that housing prices will remain relatively stable through 2023 because the national housing supply remains extremely low. That being said, after a couple of years of frenzied buying, some correction is inevitable and needed.

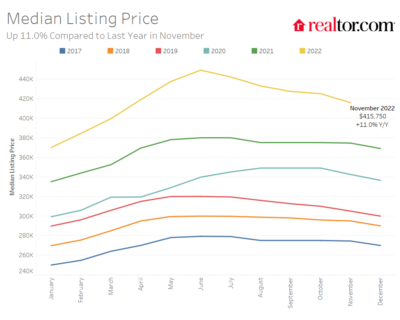

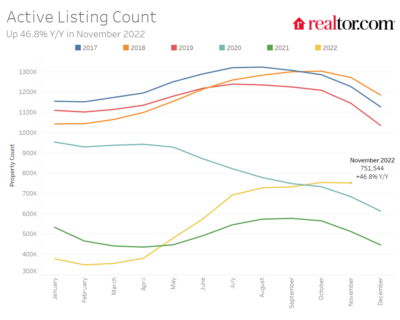

Mortgage rates are still double what they were at the beginning of 2022 and national home prices are more than 6% higher than a year ago. Higher mortgage rates have taken a significant toll on the number of sales locally and nationally. People who purchased homes in the recent past at low mortgage rates are resistant to selling. This tight inventory is expected to prevent significant decline of housing prices.

Low housing inventory has been a challenge nationally since the housing crash in 2008 when new home construction came to a halt. Housing supply still remains near historic lows but should recover some as more and more people are priced out of the market. At the current sales pace, national inventory is at a 3.3 month supply. Locally we are at 4.9 month supply. Remember months of inventory is the relationship of sales pace to the number of properties currently on the market if no additional homes were added. It is calculated by determining the average number of homes sold per month over the past year and dividing by the total number of properties for sale. A balanced market, where there is considered to be an equal number of buyers and sellers traditionally has 5 to 7 months of supply. If a market has less than 5 months of inventory it is considered a “Seller’s Market” where the seller has the advantage because demand is outpacing supply. If the supply exceeds 7 months then it is considered a “Buyer’s Market,” meaning there is excess supply and the buyer has the advantage. National inventory is up slightly from 3.1 months in September and 2.4 months a year ago, according to the National Association of Realtors. Locally our inventory has been relatively stable over the past six months. So the big question is what’s to come?

Trying to time the real estate market is similar to trying to time the stock market. Trying to predict what might happen next year is not the best investment strategy. Buyers sitting on the sidelines today in anticipation of lower prices next may end up disappointed. While the shortage of buyers may cause prices to decrease somewhat, the inventory shortage is not expected to resolve any time soon. So where do we go from here?

Summing up 2022

The shutdown from the pandemic caused a significant rebound effect on the housing market. Homes sold within hours of hitting the market, sellers were frantically cashing in and upgrading. Investors were confidently building new homes and selling them before they could finish construction. At the beginning of 2022, as inflation got increasingly out of control, mortgage rates began creeping up. The combination of increased lending fees and inflated housing costs priced most buyers out of the market and scared off many investors. This slowdown in activity is giving the housing market a much needed opportunity to rebalance. At the same time, the shortage in inventory is keeping the housing market from resetting too rapidly and causing a crash. Moving forward, unless we see a major increase in new construction nationally or we have a significant enough winter to cause a sell off in properties locally, we aren’t going to see a huge change in home prices in the near future. So, instead of waiting for much lower prices, buy a home based on your budget and investment goals. Use an investment calculator to see if you can make a property make sense for you, your timing and long term investment goals.

OUR MARKET THIS WEEK

We had 1 new condo and 1 new home come onto the market this week. We currently have 33 active condos ranging from $325,000 to $2,700,000; the median condo price is $655,000. We currently have 43 active homes on the East Shore ranging from $1,025,000 to $64,500,000 with the median price of $3,250,000. Here’s a year-to-date local update:

Local East Shore Lake Tahoe, Nevada Stats – All Year-to-Date

Total Sales YTD:

Condos: 82 (↓15% YOY) | Homes: 84 (↓44% YOY)

The Median Sales Price:

Condos: $687,500 (No Change YOY) | Homes: $1,552,500 (↑10% YOY)

Number of Sales Over $1 Million:

Condos: 17 = 20% (↑7% YOY) | Homes: 71 = 84% (↑11% YOY)

Highest Priced Sale:

Condos: $5,665,500 (↓5% YOY) | Homes: $32,000,000 (↓33% YOY)

Median Price Per Square Foot:

Condos: $595.68 (↑10% YOY) | Homes: $663.27 (↑8% YOY)

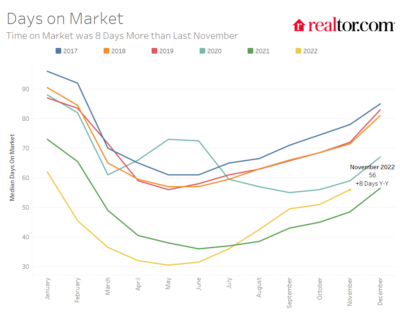

Median Days on the Market:

Condos: 78 (↑42% YOY) | Homes: 76 (↑9% YOY)

List to Sell Price:

Condos: 98% (↓6% YOY) | Homes: 97% (↑3% YOY)

Price Reductions this Week:

Condos: 1 | Homes: 2

If someone you care about needs guidance or recommendations, please share our contact information as we are honored to be able to help! If you would like to receive our in-depth market update or would like an evaluation of your property’s value we would love to hear from you! We’ve put together some information below that we think you’ll find useful. If you have anything you want to share with our community please let us know so that it can be included in future newsletters.